There are many ways that insurance companies try to maintain an edge in a competitive industry. One of the biggest secret weapons at their disposal is big data. But what is this type of data, and how does this industry apply it? Here is a quick overview, complete with examples of how big data is used.

Table of Contents

Why Are So Many Companies Embracing Big Data to Get An Edge?

Big data is too large or difficult to process using traditional analytical methods. There are a few elements that are used to define big data, these are:

- Speed.Thanks to the Internet of Things (IoT), businesses can collect data faster than ever. For example, a tracker on a car can provide a stream of data in real time.

- High volume of data. Big data consists of large data sets. The sheer volume of the data makes it difficult to process.

- Wide range of data. Usually, big data can be broken into two general subsets. It can either be structured, like a numerical data set. Or it can be unstructured, like words or phrases given in response to quiz questions. Many data sets can be created with each of these subsets.

Here are some examples of the types of things that would be included in big data:

- Social media. This can include things like comments posted and which hashtag is trending. This can be a good way of gauging what people think about an insurance company.

- Public data sets. The government can gather much information about citizens. For example, through the census. This can be released to the public and provide valuable insights for businesses.

- Private big data. This is the information gathered by private companies. For example, insurance companies will know someone’s name, age, address, and type of policy they have.

- Streaming data. This information comes from the IoT. For example, it could be a smartwatch that monitors the number of steps people take or a monitor in a car that tracks how they drive.

Using Big Data To Get An Edge

The problem with such a large data set is that it can be challenging to process. Often, it can be cost-prohibitive for smaller companies to try and break it down.

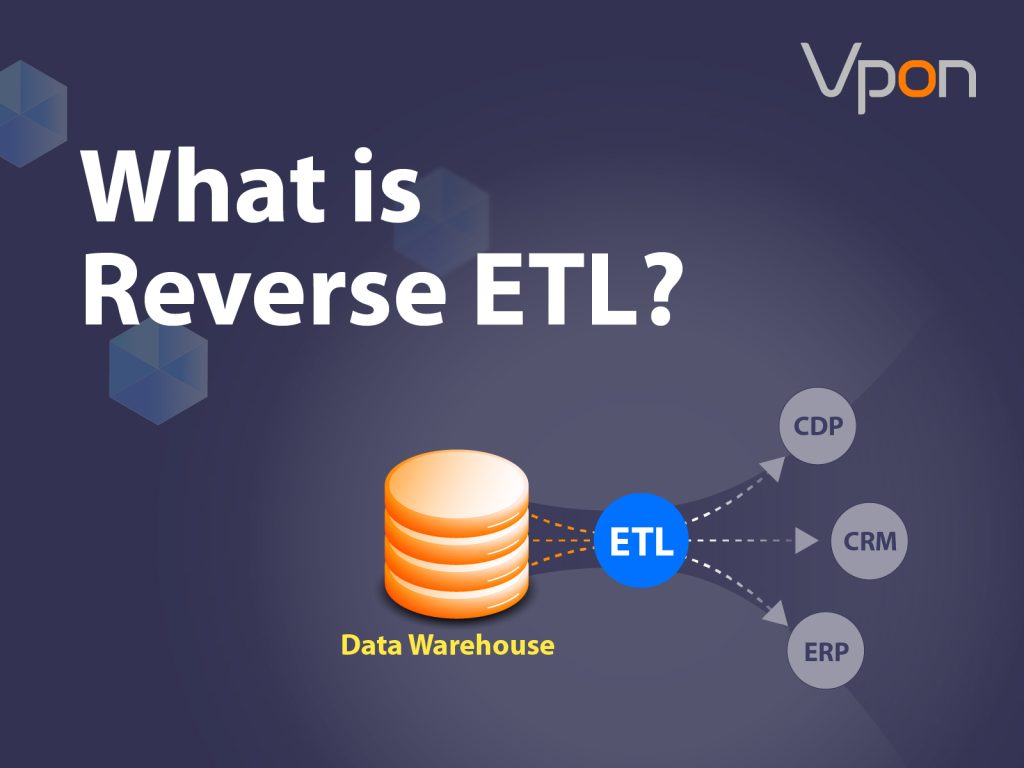

However, it can be hugely beneficial for companies with the resources and skills to delve into big data. It can create unique insights into how someone is likely to behave. The more data they have, the greater the understanding they will be able to create. In fact, some companies use a global data platform to gain more valuable data from other data sets which can uncover new opportunities or threats.

For example, insurance companies can gain insights into how a person is likely to behave. This allows them to determine how risky their behavior is expected to be and the risks they will need to make a claim. This ensures that their premiums are priced correctly.

In many cases, a third-party company will do this type of analysis. However, larger firms might have the resources to do it in-house. Using big data will give them access to powerful algorithms that help them determine which data is relevant. Then, it will start analyzing it, looking for beneficial insights.

What Are the Benefits Of Big Data?

As you can imagine, a business owner might want to employ big data for several reasons. Some of the most significant benefits include the following:

- Ability to gain insights into customer behavior

- Accurately judging risks

- Creating a more targeted ad campaign

- Finding fraudulent behavior

- Spotting anomalies fast

This list is just the beginning of the advantages of a big data set, with all industries able to benefit. As more data is analyzed and more connections are made, big data will grow even more valuable and can provide a broader range of insights.

What Are Some Examples of How Companies Use Big Data By Insurance Companies?

The type of data you can gather is less important than how you will use it. To illustrate this point, let’s look at ten examples of how an insurance company might utilize big data.

Accurately Assessing Risk

One of the essential elements an insurance company needs to calculate is the risk of events occurring accurately. A miscalculation in this area could be costly, with the insurance company potentially losing much money.

Big data allows insurance companies to gather more information about potential risk events. This allows them to understand better the odds that the event will occur. As a result, they will be able to ensure that their policies are priced effectively. It can also help them decide what aspects their policies will cover.

Creating More Personalized Insurance Premiums

Big data can allow insurance companies to gather much information about the habits of their customers. This can enable them to offer more personalized policies.

For example, they can adjust the pricing based on the risk that a customer will pose. If a younger driver doesn’t have a history of making claims and demonstrates safer driving habits, they might be able to get a lower rate than an older driver.

Finding New Customers

For an insurance company to grow, it will need to be able to keep finding new customers. Big data can help with this aspect of the business. It can be used to identify new ways to identify customers. It can also find the most effective way to market them.

Proactively Reducing Risks

As we mentioned, big data will allow insurance companies to gauge a potential event’s risks accurately. This will enable them to step in early if a likely risk event could occur. This can help them to limit the impact on customers. In turn, this will reduce the compensation they will need to provide.

Personalizing The Customer Experience

There are numerous ways that big data can help insurance companies create a better experience for the customer. For example, insurance companies can analyze comments on social media. This will allow them to find what people are unsatisfied with and take steps to improve their image. Another option is to change their website’s appearance or offer more customer support.

Ability To Better Detect Insurance Fraud

One of the highest costs for insurance companies is fraud. It’s estimated that the industry loses around $309 billion yearly to fraudsters.

Big data will be able to help combat the rise of fraud. It can be used to find inaccurate customer statements. It can also look at the case history of a customer. This allows the companies to pinpoint cases requiring further investigation before the claim is approved. By using this technology, insurance companies will be able to save thousands of dollars each year.

Making Internal Processes More Effective

Insurance companies are often big organizations. As a result, there are a lot of internal processes that need to be completed to ensure that everything is functioning correctly. Big data can be used to spot inefficiencies in these processes, helping insurance companies keep their company functioning optimally. This will save both time and money.

Cutting Costs Through Automation

One of the best ways for an insurance company to save money is to find ways to automate. This lets them reduce the number of people required while ensuring the same level of service. Big data will be able to help organizations find which elements can be optimized through automation and can help implement these changes.

Improving Customer Retention

Big data can be used to find people who are unhappy with the company. This allows them to take some steps to help them feel better. Sometimes, this can include things like offering a personalized discount.

Understanding The Market Conditions

Big data is an excellent way of conducting market research. This can allow an insurance company to gain valuable insights into how potential customers feel. For example, it can help insurers find the maximum amount each demographic is willing to pay for insurance. Big data can also identify which demographics are most likely to forgo insurance.

These insights can be used in a range of ways. It can help them learn whom to target in a marketing campaign. It can also help them decide the way they set their prices.

Conclusion

Big data is quickly changing the way that insurance companies operate. It allows them to learn more about their customers and better evaluate risks. Furthermore, the data sets used to create big data continue to grow. This means there will always be new ways of assessing it, allowing even more insights to be generated. See some actual big data case studies applications for finance & insurance in action. Vpon Big Data Group has teams of data scientists and experience in helping insurance & finance enterprises achieve their data needs. Need a data specialist to help your business, contact us today.