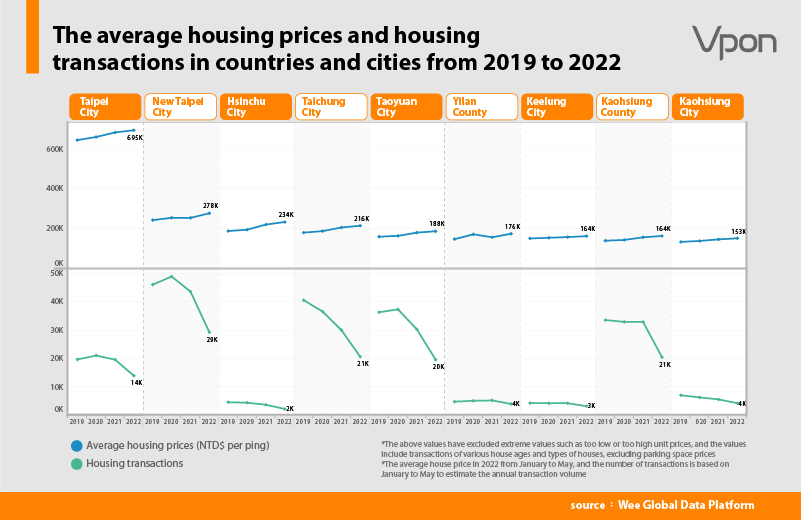

Taiwan faces an era of high housing prices, and “looking at the house” has always been a phenomenon. Recently, under the influence of the epidemic, interest rate hikes, inflation, etc., although the housing market in various counties and cities has significantly cooled down, high house prices have become a fact, and the difficulty of buying houses is getting higher and higher. According to the Department of Land Administration of the Ministry of the Interior, Vpon statistics estimate real estate sales’ actual price registration batch data. It combines the residence label of Taiwan mobile device of “Wee Global Data Platform“, the consumption data of Taiwan mobile device, and Taiwan mobile device. Consumption data. Use big data to explain the current residence situation in Taiwan and interpret the trading needs of the real estate market.

In addition to macroeconomic factors, the characteristics of urban scale, per capita income conditions, population mobility, and land supply are the main reasons that drive housing prices. Analyzing the big data mentioned above, in terms of housing prices, countries and cities are still in a small state of a slight rise, ranking in terms of the average price per ping in 2022. Taipei has an average of New Taiwan dollar (NTD$) 700,000 per ping, which is much higher than twice the average of other counties and cities. The second is New Taipei City. The development of Hsinchu Science Park drives the housing market in Hsinchu City. The average house price ranks third in Taiwan and has a strong growth force.

Figure 1. The average housing prices and housing transactions in countries and cities from 2019 to 2022

Five maps to see the living conditions in Greater Taipei

Resident Population

The resident population is concentrated in Taipei City, the southwest region of New Taipei City, Taoyuan District, and Zhongli District

According to the mobile data of Vpon’s “Wee Global Data Platform“, the location that the user to stay most frequently at night is regarded as the place of residence, and the administrative region of the northern region is colored according to the number of the resident population. The deeper the orange represents, the larger the residential population, and the deeper the blue, the smaller the residential population. As can be seen from the heat map below, the residential population in the northern area is concentrated in Taipei City, extending north to Tamsui, east to Xizhi, and southwest to Banqiao, Zhonghe, Xinzhuang, Sanchong, Xindian and other districts as densely populated areas, and extend to all districts of Taoyuan City.

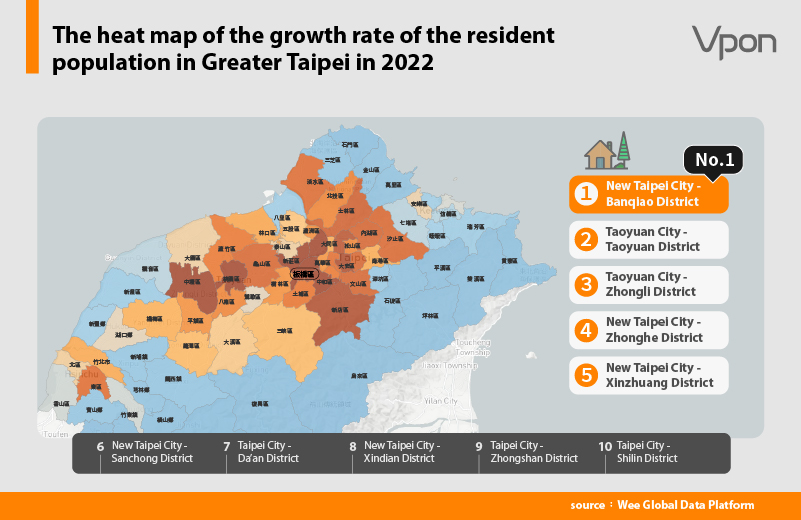

Figure 2. The heat map of the growth rate of the resident population in Greater Taipei in 2022

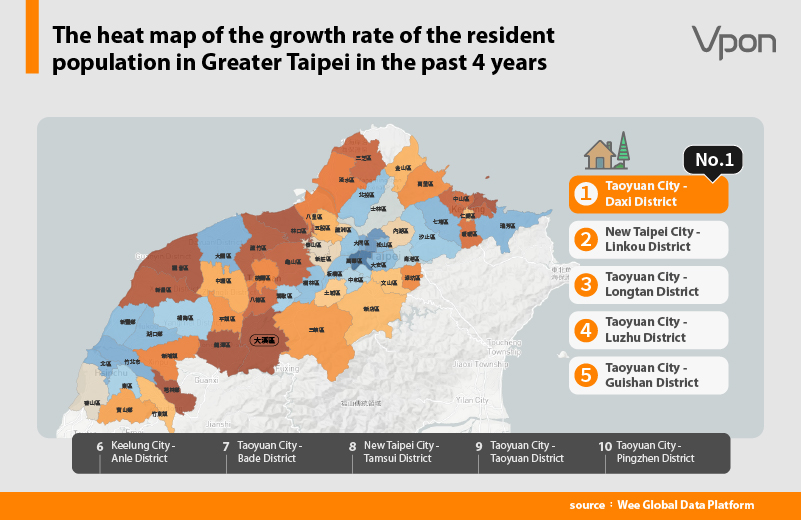

Resident Population Growth

The resident population in egg white and eggshell areas is growing rapidly

Learn more about the changes in the residential population in the past four years and draw the growth rate of the residential population in the heat chart below. The deeper the orange, the higher the residential population growth in the past four years, and the deeper the blue, the higher the negative growth of the resident population.

The resident population of the traditional Taipei City and New Taipei City egg yolk area has been saturated and is no longer growing. Instead, the population has gradually expanded to Neihu District, Wenshan District and other areas, showing a slight growth rate. The population in the surrounding areas, such as Linkou, Tamsui, Sanxia, Sanchong, Taoyuan and Keelung, has also grown.

Figure 3. The heat map of the growth rate of the resident population in Greater Taipei in the past 4 years

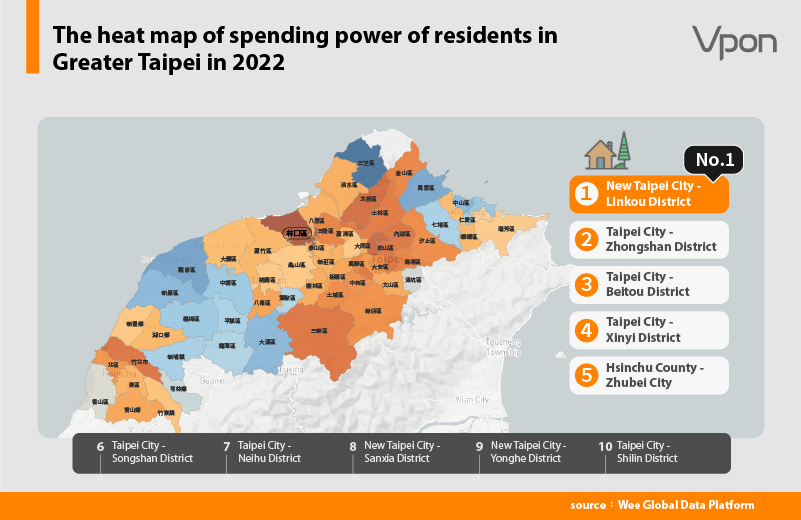

Resident Spending power

Linkou residents have strong spending power, followed by Zhongshan, Beitou and Xinyi District residents in Taipei

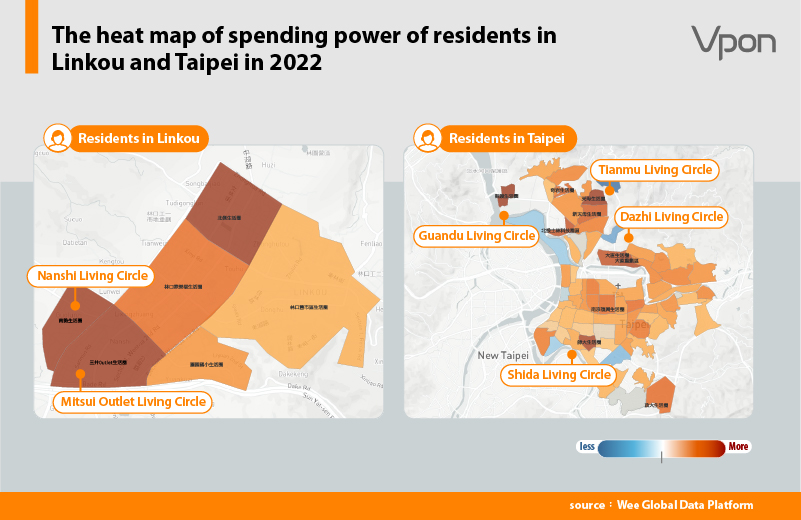

Vpon’s data team uses the consumption data of “Wee Global Data Platform” to integrate and estimate users’ consumption data across Taiwan according to the user’s place of residence to understand the residents’ spending power in each administrative region. In the heatmap below, the deeper the orange color, the higher the spending power of the residents in the area, and the deeper the blue, the lower the spending power. The figure shows that the residents’ spending power in the Linkou District of New Taipei City is the strongest in the northern region. It is speculated that Linkou is beneficial from their all-rounded medical resources, transportation system and amenities, attracting healthcare professionals, middle and high-income residents. Further analysis of all districts in Linkou New Town, the former Mitsui Outlet living circle is the core area of Linkou, adjacent to facilities including Mitsui Outlet, Ambassador Theatres, and subway stations, etc. The Mitsui Outlet living circle and the adjacent Nanshi living circle are the areas with the strongest spending power of residents in the new town.

In Taipei City, the residents of Zhongshan District, Beitou District and Xinyi District have the strongest spending power. Regarding a smaller range of living circles, the high-spending groups mostly live around Guandu, Tianmu, Dazhi and National Taiwan Normal University. Outside Taipei City and New Taipei City, Zhubei City in Hsinchu County is the first choice of residential for the science and technology professionals, with the spending power ranked fifth among the administrative regions in the northern region.

Figure 4. The heat map of spending power of residents in Greater Taipei in 2022

Figure 5. The heat map of spending power of residents in Linkou and Taipei in 2022

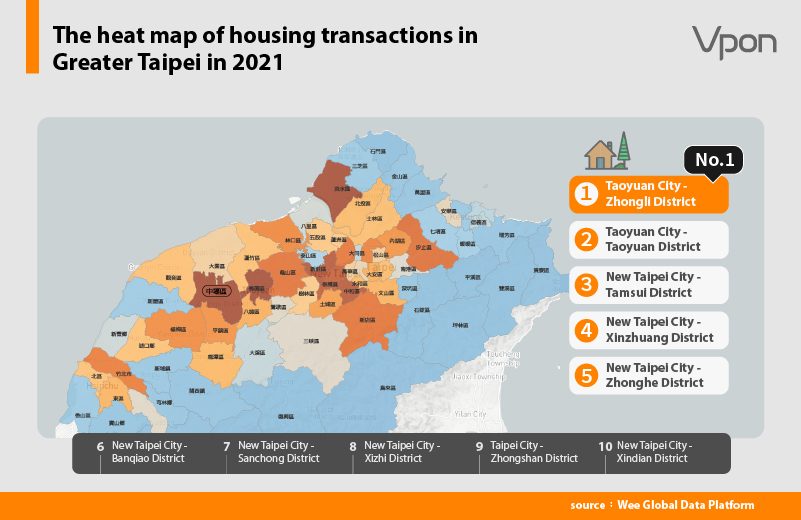

Heat map of the housing market in various regions of Greater Taipei

Housing Transaction

High Transaction in Zhongli, Taoyuan, Tamsui, Xinzhuang and other popular rezoning areas

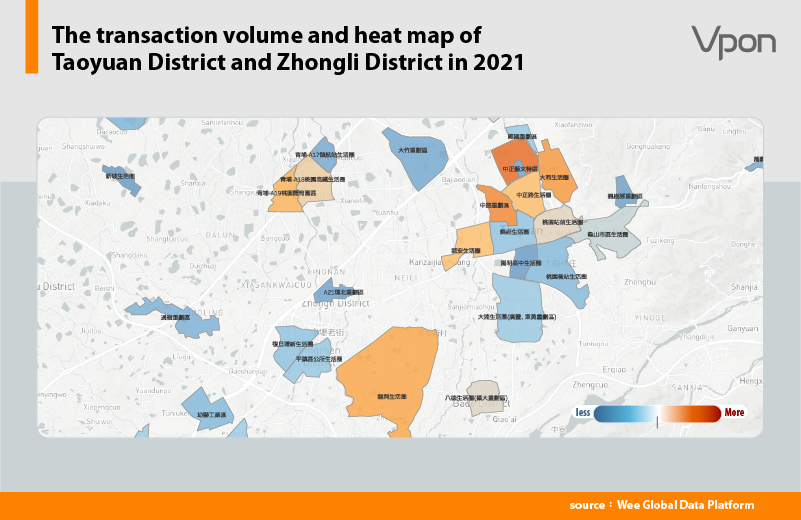

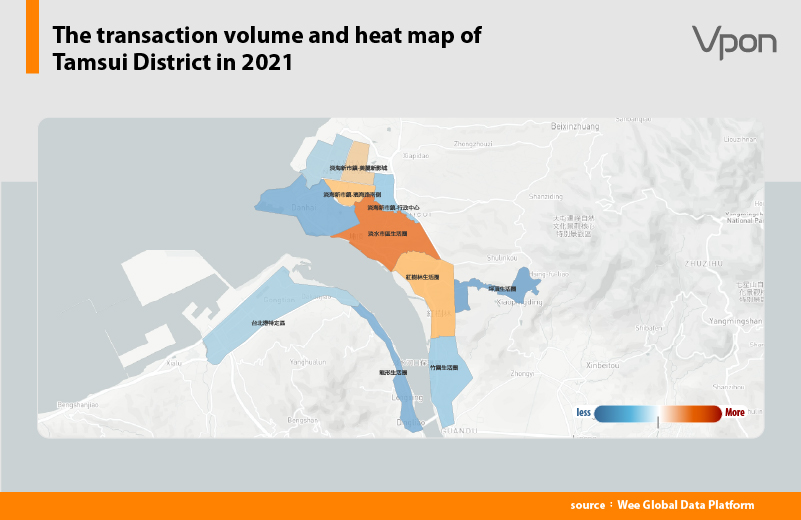

Based on the housing transaction of 2021 we can observe the popular area in the housing market. The northern housing market’s first and second hot areas are Zhongli District and Taoyuan District of Taoyuan City. The top trading areas of Zhongli are concentrated around Qingpu A18 and A19, while the Arts and Cultural Business District and the recent rejuvenation makes it a popular area in Taoyuan City. The third highest trading area is Tamsui District in New Taipei City. With the construction project of the light rail, Danjiang Bridge and many new facilities begin in Tamsui urban area, Tamsui New Town, and Mangrove areas, it brings up the housing transaction. Xinzhuang, which is in fourth place, is a hot trading area with Xinzhuang Sub-city Center and Touqian Redevelopment zone.

Figure 6. The heat map of housing transactions in Greater Taipei in 2021

Figure 7. The transaction volume and heat map of Taoyuan District and Zhongli District in 2021

Figure 8. The transaction volume and heat map of Tamsui District in 2021

Housing Prices

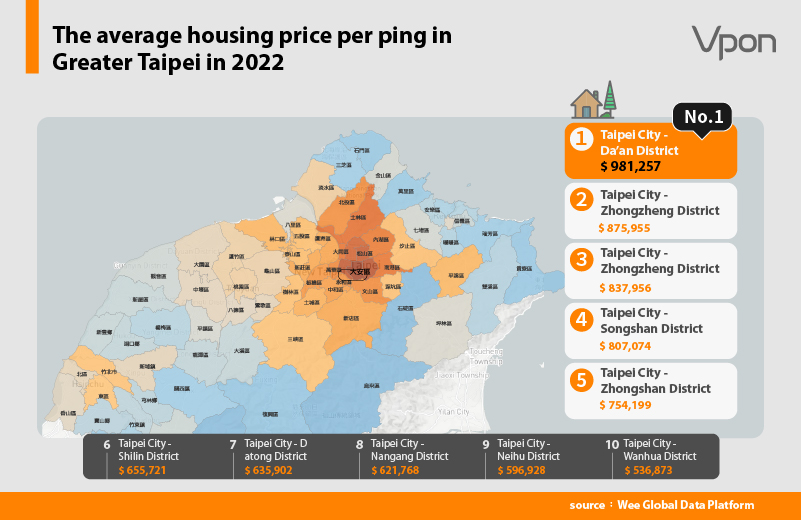

High housing prices in Taipei, Zhonghe and Yonghe, Banqiao are closely behind

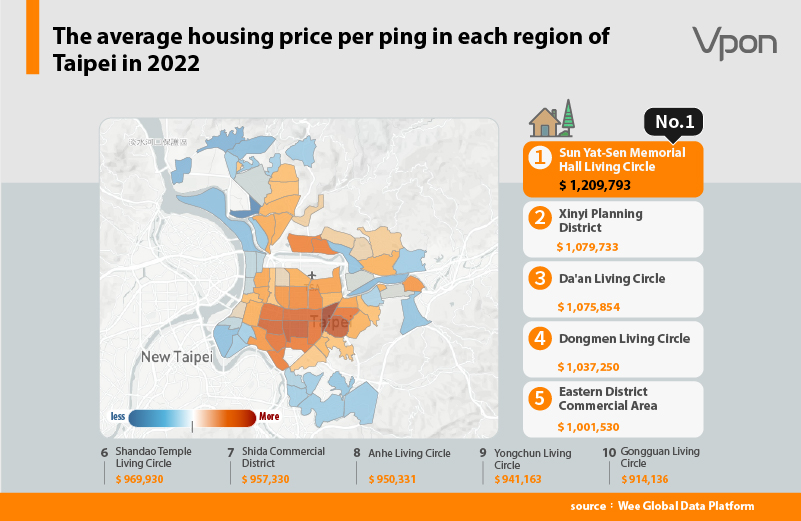

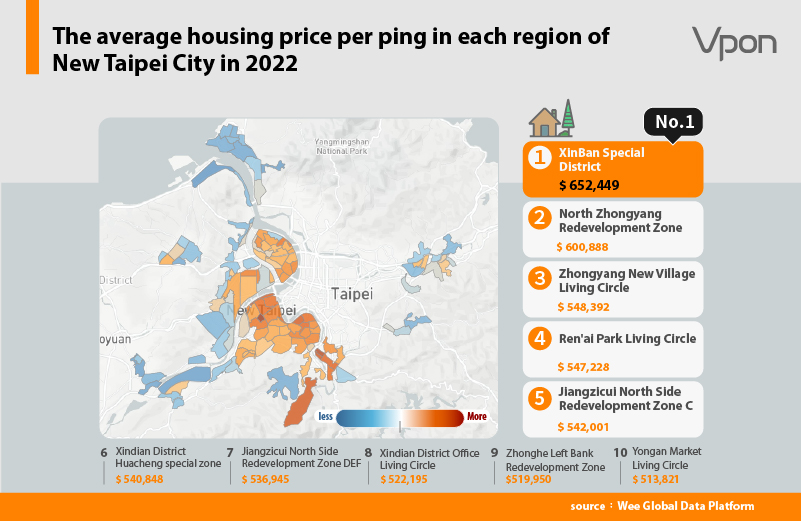

It is not a secret that the housing price in the egg yolk area of Taipei City is extremely high. The highest average housing administrative district in Taiwan is Da’an District in Taipei City, and the area with the highest average is located in the Sun Yat-Sen Memorial Hall, Xinyi Planning District, Da’an, Dongmen and Eastern District, with an average of more than NTD$ 1 million per ping. Outside of Taipei City, the housing prices of Yonghe, Banqiao and Zhonghe are close to Taipei City. Among them, the XinBan Special District, Jiangzicui North Side Redevelopment Zone DEF, Xindian District Office Living Circle, Zhongyang New Village Living Circle, Ren’ai Park Living Circle have top housing price in New Taipei City, thanks to close proximity to the city center, the all-rounded community planning, relaxing green areas and high quality of lifestyle.

Figure 9. The average housing price per ping in Greater Taipei in 2022

Figure 10. The average housing price per ping in each region of Taipei in 2022

Figure 11. The average housing price per ping in each region of New Taipei City in 2022

Strong, rigid demand for egg yolk and egg white areas

Compared with the number of residential population and housing transactions in various districts of Taipei, the population trend is roughly in line with the trend of housing transaction volume. Areas with a high residential population also show a higher housing transaction volume, especially in Taoyuan, Zhongli, Banqiao, Xinzhuang and Zhonghe, these areas show a high among the northern regions. The demand for rigid housing in these areas is very strong.

High spending power groups stay away from the egg yolk area

Comparing residents’ spending power in each district with the average housing price, residents’ spending power in the egg yolk area of the Taipei City and New Taipei City area is similar. However, the housing price can be drastically different, depicting the reason behind the downdrift in population of the egg yolk area and the surge in the population of the egg white area. The housing prices in each district outside of the egg yolk area aligns with the residents’ spending power. High spending power groups concentrates mostly in medium-high housing price areas, but several medium-low housing prices areas, including Linkou, Sanxia, Wugu and Xizhi, are still popular among young professionals of the group.

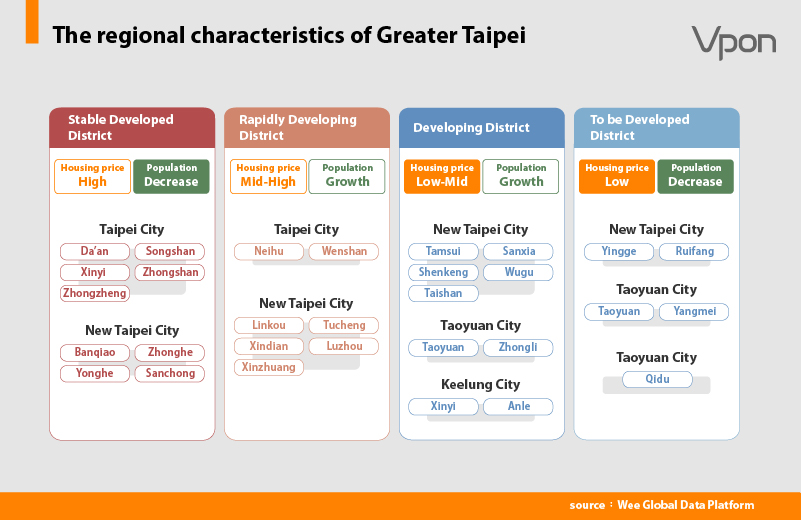

What are the characteristics and issues of different regions?

Based on the growth rate of the population and the level of housing prices, we can summarize the developing status of various districts in Greater Taipei. For instance, the egg yolk areas, including Taipei City regions, New Taipei Banqiao, Zhonghe and Yonghe and Sanchong, at a stable developed stage would show a high housing price and a decrease in population, these districts are in quest for housing justice issues.

On the other hand, Neihu and Wenshan District in Taipei City, Linkou, Xindian, Tucheng, Luzhou and Xinzhuang District in New Taipei City, are examples of districts that has rapidly developing and reached a higher lifestyle and facilities standard, while the housing price cannot be compared to the egg yolk area, it is rising as the younger generation migrate and settle down in these districts. For these new migrants, the quality of life and the community are the top factors they search their new home.

The population of eggshell areas such as Taoyuan District, Keelung District, New Taipei Sanxia, Shenkeng, Wugu and Taishan, is growing aggressively, while the housing price is still at an affordable medium-low level, making these districts a cost-effective choice for young home buyers. Their primary needs are areas with an all-rounded basic living facilities and transportation.

Figure 12. The regional characteristics of Greater Taipei

[Linkou New Town] and [Qingpu Special Zone] Audience profile of the residents in the popular migration area

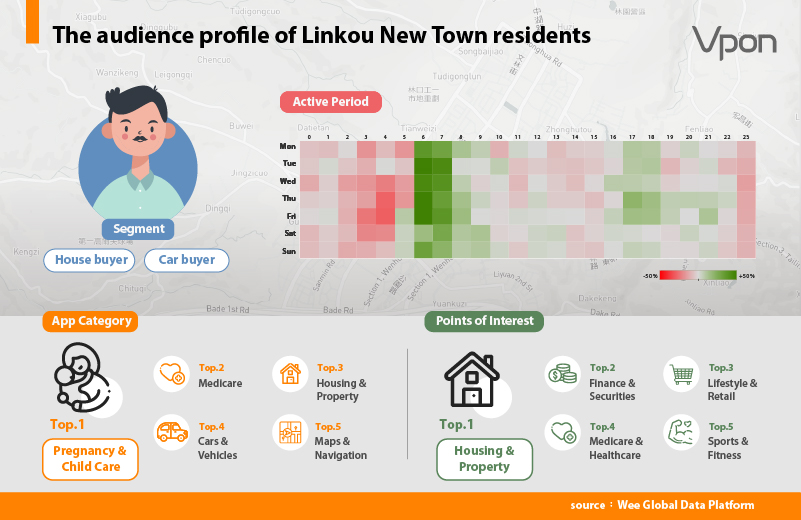

[Linkou New Town] Utopia for young families

Linkou stood out from other administrative districts in many ways, for instance the rapid growth in residential population and their high spending power. Linkou is also the district with the youngest and highest average income residents in New Taipei City. Linkou New Town has become the utopia for migrants with high-spending power in Greater Taipei.

Through the Vpon’s audience profile analysis report of Linkou residents, we can see that what set these new migrants apart from migrants in other areas are the fact there are more house and car buyers in Linkou and show high interest in digital ads about house purchase and car purchase. As the district is filled with young families, and healthcare professionals, the audiences also show interest in mobile apps related to pregnancy, childcare and medicare. In terms of audience behavior, Linkou residents generally get up earlier, and visit finance-, retail- and medicare-related locations.

Figure 13. The audience profile of Linkou New Town residents

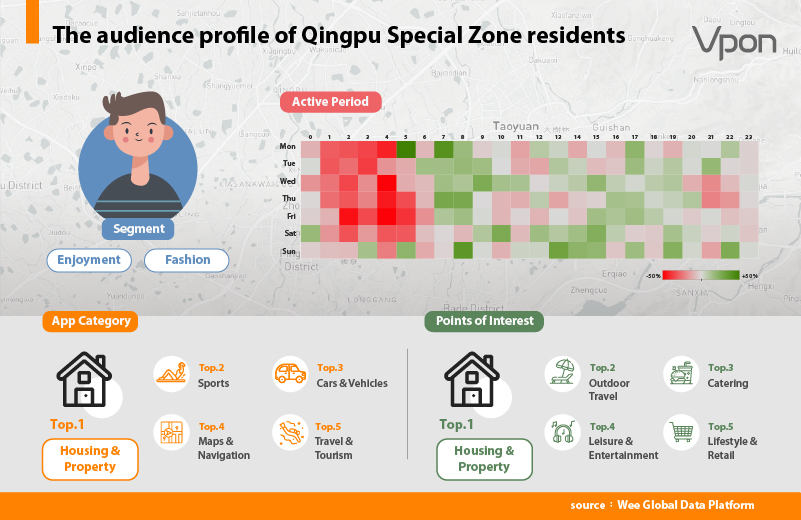

[Qingpu Special Zone] The first house buying choice for active youth

As the Qingpu Special Zone of Taoyuan City is close to high-speed rail and subway, with large shopping mall and facilities under constructions, the district recently reached a high housing transactions volume and a rapid population growth. While the district attracting workers in Taoyuan, it also attracts house buyers who works in the Greater Taipei area. Vpon’s audience analytics report also shows that the Qinpu residents appeared to be fashion lovers and value their lifestyle outside of work; there is a preference of using mobile app that are related to cars, navigation, tourism, and their preferred locations are often related to travel, food and entertainment. In terms of living habits, as there are not many facilities that open till late, the Qingpu residents are relatively less active at night.

Figure 14. The audience profile of Qingpu Special Zone residents

Vpon’s “Wee Global Data Platform” accurately grasps the development of each region in Taiwan and provide an in-depth analysis of the residents in each district. Wee can assist the government and enterprises with municipal planning and commercial economy with accurate data as the foundation, unveil the potential of each district to support a data-driven development of the community and economy.

Source: Wee Global Data Platform

- Vpon Taiwan mobile device residence label

- Vpon Taiwan mobile device consumption data

- Vpon audience insights report

- The real estate sales’ actual price registration batch data from Department of Land Administration, M.O.I. (processed for analysis and excluding extreme values)