A wide spectrum of media outlets and channel fragmentation provide mobile users with an abundance of choices to receive news and enjoy entertainment. Despite the blooming of social media and discussion forums, TV, news and entertainment apps remain a mainstay. The fierce competition and the enormous fragmentation of audience usage, time and behaviour appear to be an insurmountable challenge to publishers and marketers, yet with thorough comprehension of audience profiles and app trends, they can make wise business decisions and optimise returns.

In this report, Vpon casts a new eye on news (with TV Live, Chinese and English text-driven) & entertainment (TV & radio) apps in Hong Kong leveraging the owned data platform – AppVois from our proprietary data sets, aiming to deliver a holistic view of the news & entertainment app market trend and to uncover audience preferences & behaviours.

Table of Contents

High market penetration of news and entertainment app

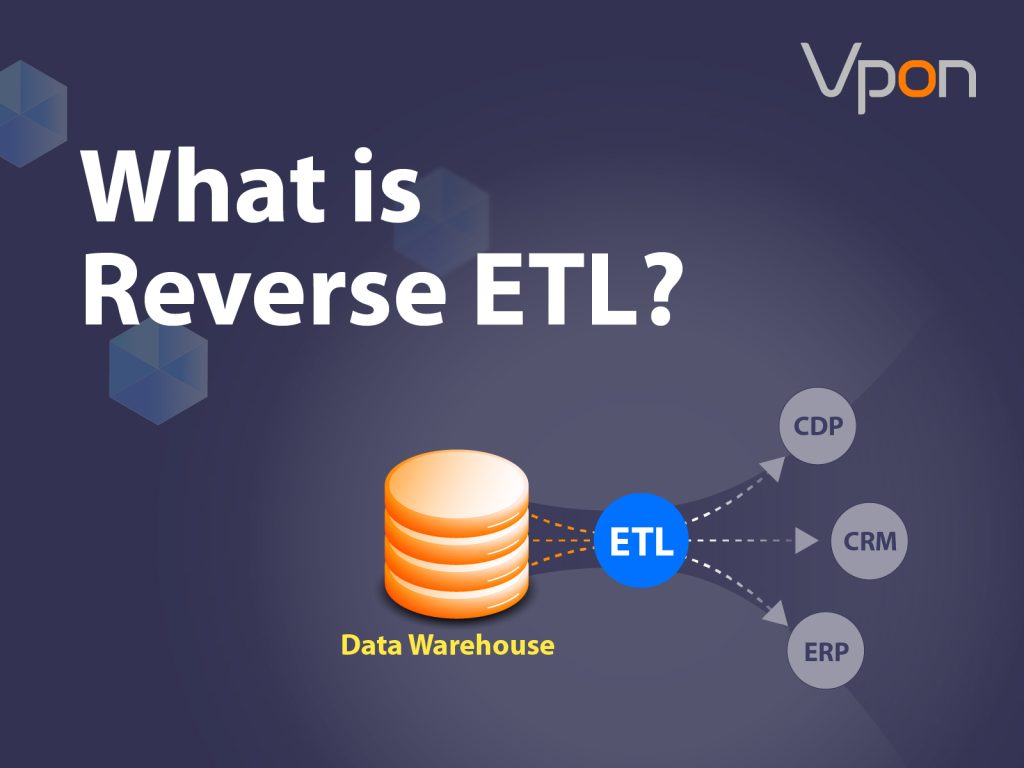

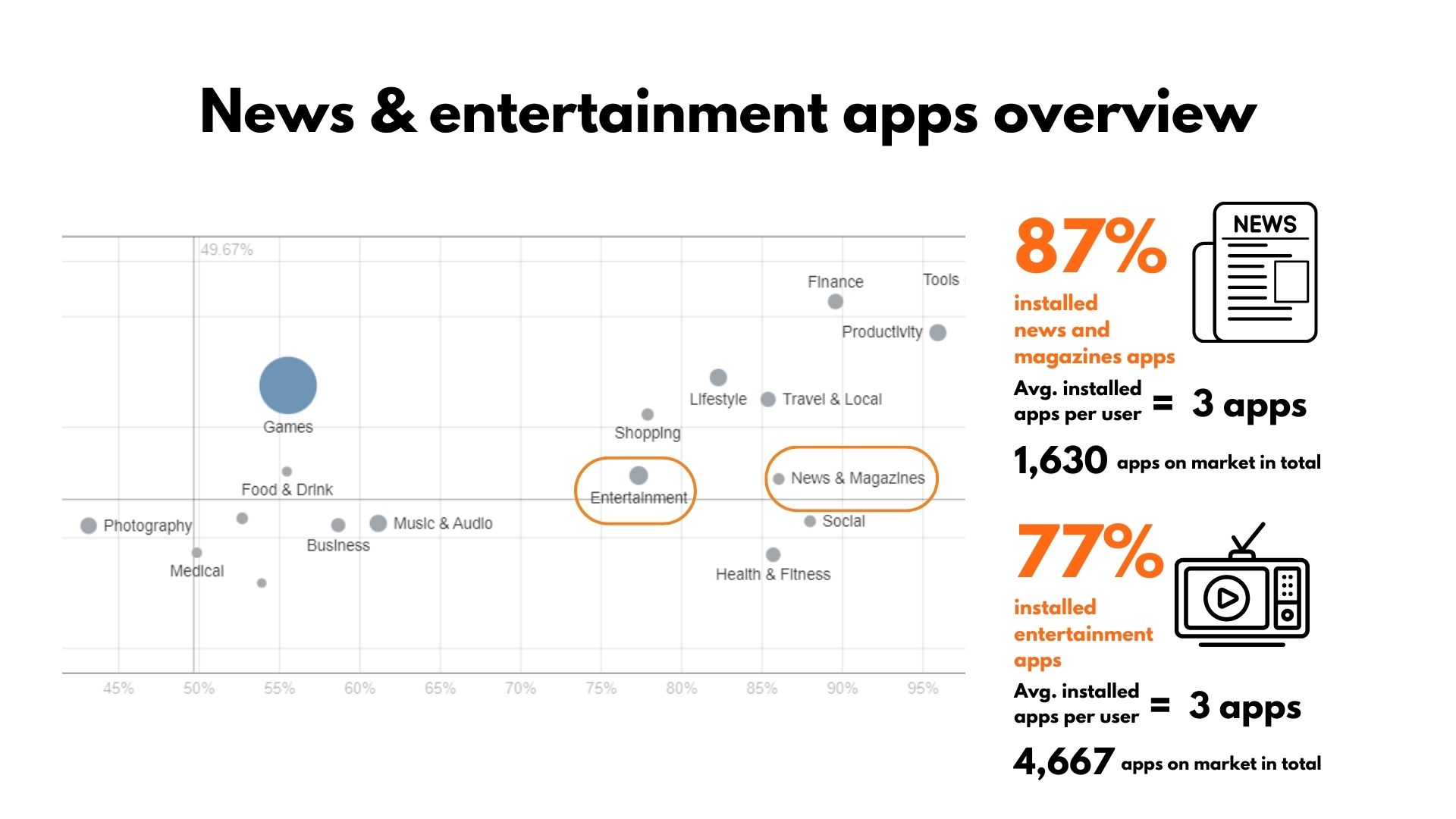

According to Vpon’s AppVois platform, as of end-Jan 2023, 87% and 77% of users have installed news & magazines and entertainment apps on their smartphones, with an average of three apps installed per user in each category.

▲ Figure 1 – category landscape of HK App Market – News & Magazines, Entertainment

Diverse audience profile among four major TV apps with live news

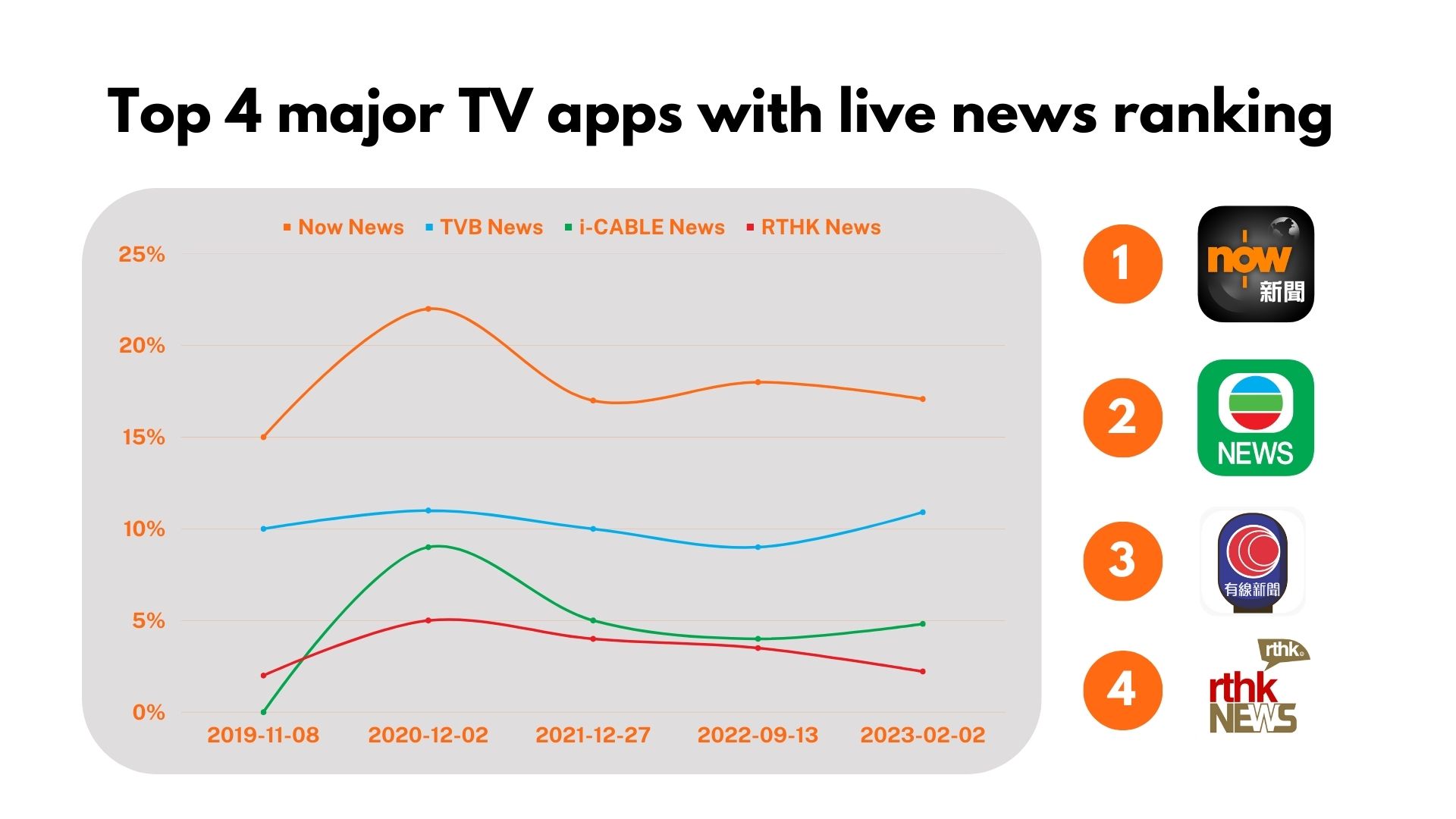

Now News ranked No.1 among four major TV apps with live news, with market penetration of 17%, followed by TVB NEWS, i-CABLE News and RTHK News. According to AppVois’s audience app preference, these four apps’ audiences have installed other news apps, such as South China Morning Post, news.gov.hk, Ming Pao News, to name yet a few, indicating audiences tend to rely on multiple outlets to receive news.

▲ Figure 2 – market penetration of four major news apps with TV Live – Now News, TVB NEWS, i-CABLE, RTHK News

When evaluated by individual app audience preference, it is observed that audiences show an inclination of various interests –

- Now News is the only app that has Baby Kingdom on the Top 10, showing the audience have higher chances to be parents with kids and they also appear to be sports fanatics with Now Sports and Decathlon app installed.

- TVB News audiences expect to receive news and the latest government policies with apps installed such as news.gov.hk, GovHK Notification, GovHK Apps

- i-CABLE audiences are expected to be property owners/investors, with apps installed like 利嘉閣‧按揭易, smartME and Hong Kong Property

- RTHK News audiences have the strongest tendency to read or prefer reading English news given profile has Fox News, The Guardian, South China Morning Post, CNN Breaking US & World News apps installed

▲ Figure 3 – audience app preference of four major news apps with TV Live

Distinctive app interest and behaviour of Chinese news (text-driven) apps

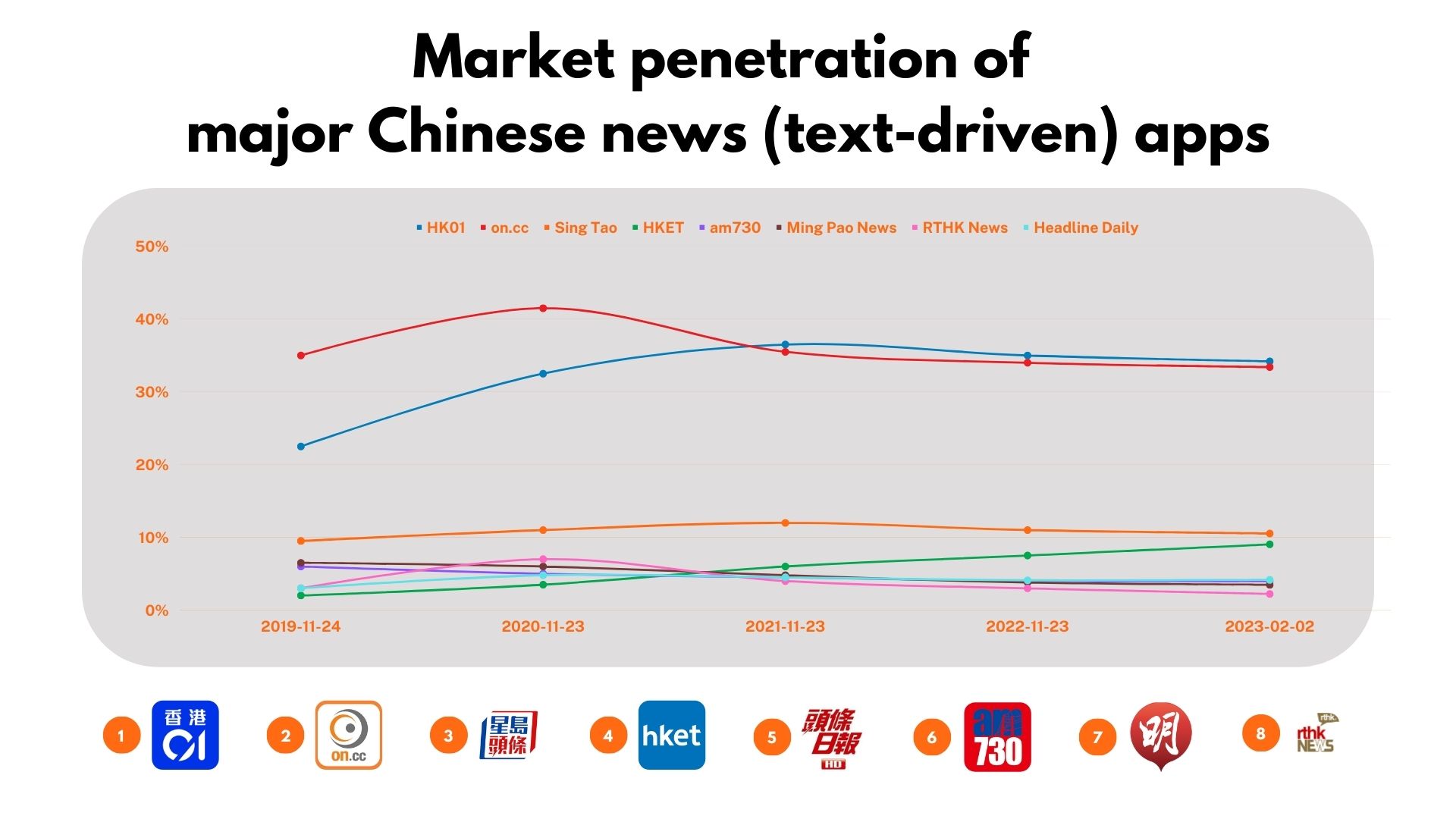

HK01 and on.cc outperformed their counterparts of TV apps (Chinese text-driven) with market penetration above 33%. Followed by Sing Tao and HKET with approximately 9-10% penetration. As for am730, Ming Pao News, RTHK News and Headline Daily, the penetration remains 2.5-4.2%.

▲ Figure 4 – market penetration of news app (Chinese text-driven)

Contrary to news apps with TV Live, the majority of audiences of news apps (Chinese text-driven) do not install many other news apps. Based on AppVois audience app preference, they have distinctive interests in various topics:

- HK01 audiences show strong signals of being outdoor & entertainment lovers, with Weekend Weekly, UA Cinemas and Decathlon installed. Given Baby Kingdom ranked top on app preference scale, audiences are also likely to be parents with children.

- On.cc audiences tend to be parents with kids, similar to HK01 with Baby Kingdom ranked first. Yet with LiveScore, 馬場Boss, 馬會電視頻道 apps installed, audiences are assumed to be soccer and/or horse racing enthusiasts.

- HKET audiences are apparently interested in finance & property investment, as 8 out of 10 top preferences are related apps, such as EDigest, StockViva and Home Expert.

- Sing Tao audiences are probably value-for-money shoppers, illustrated by apps installed like Price.com and JETBUY.

▲ Figure 5 – audience app preference of news app (Chinese text-driven with penetration 9% or above)

Unlike news apps (Chinese text-driven) with penetration 9% or above, audiences of the same app type with penetration 2.5-4.2% have few other news apps installed. However, Ming Pao News and RTHK News are discovered to have language preference in English, given audiences have English news apps downloaded, for instance, Fox News, South China Morning Post, The Guardian, and Wall Street Journal. While am730 and Headline Daily seem to be Chinese local, with a higher proportion of Chinese news apps installed, like Sky Post and Bastille Post.

▲ Figure 6 – audience app preference of news app (Chinese text-driven with penetration 2.5-4.2%)

3Is for English news (text-driven) app audience - Inquisitiveness, Investment & Indulgence

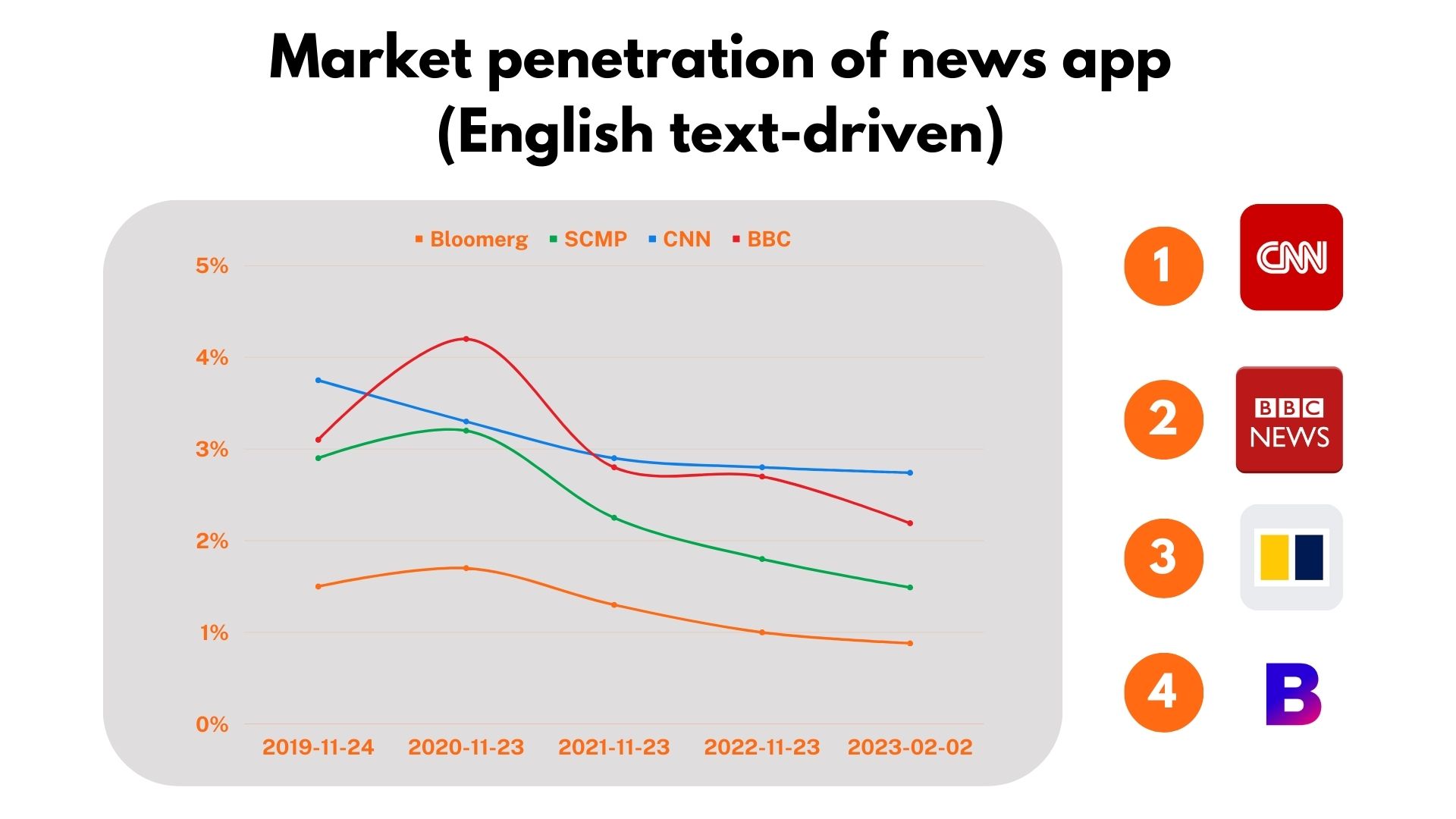

News apps (English text-driven) market penetration ranges from 0.2% to 2.7% in Hong Kong, CNN Breaking US & World News ranked first with penetration reaching 2.7%, followed by BBC News, South China Morning Post and Bloomberg. A slightly downward trend could be noticed in the past couple of years within the English text-driven news app market.

▲ Figure 7 – market penetration of news app (English text-driven)

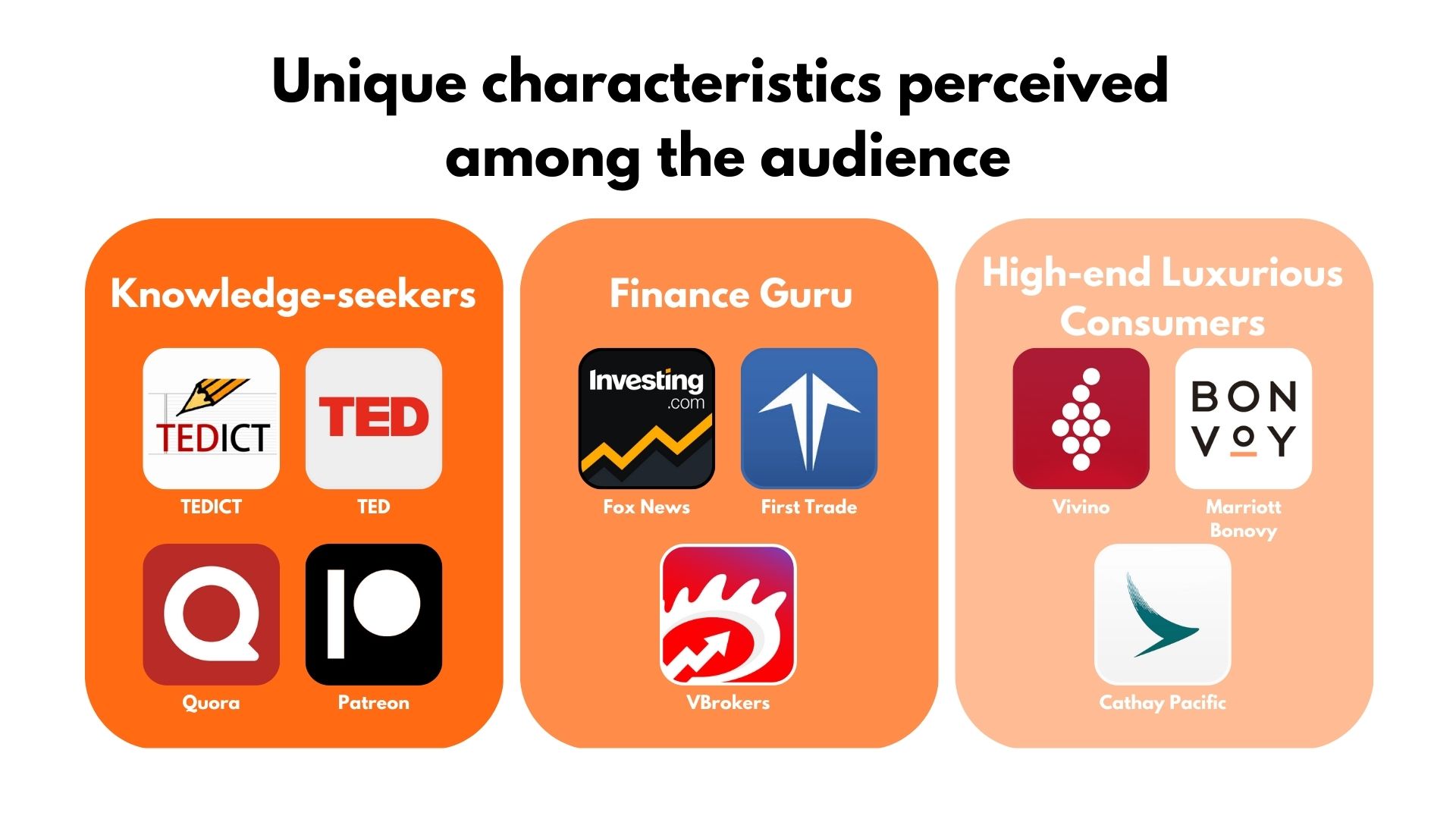

There is no doubt that top-ranked news apps (English text-driven) share a similar profile of having audiences who are likely to be English native speakers, since most of them have other English news apps installed. However, when deep dive by individual app preferences, there are three unique characteristics perceived among the audience:

- Knowledge-seekers: discussion forums & content platform apps downloaded, such as Patreon, Quora, TED and TEDICT

- Finance Guru: property & investment apps installed like Investing.com, First Trade and VBrokers

- High-end luxurious Consumers: premium membership apps installed, for example, Vivino, Marriott Bonovy and Cathay Pacific

▲ Figure 8 – audience app preference of news app (English text-driven of penetration above 0.8%)

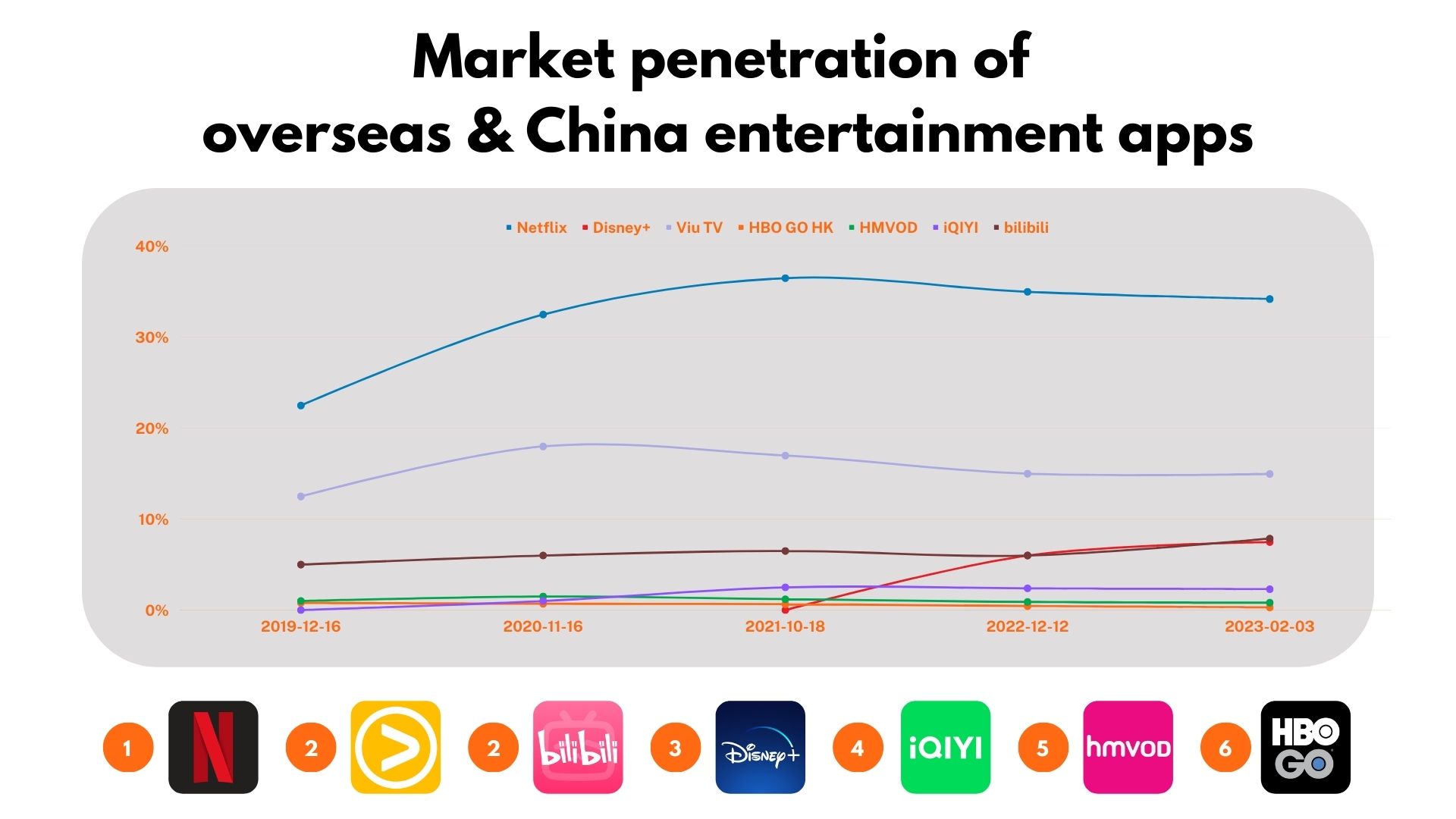

Netflix surpassed myTV SUPER in market penetration among entertainment apps

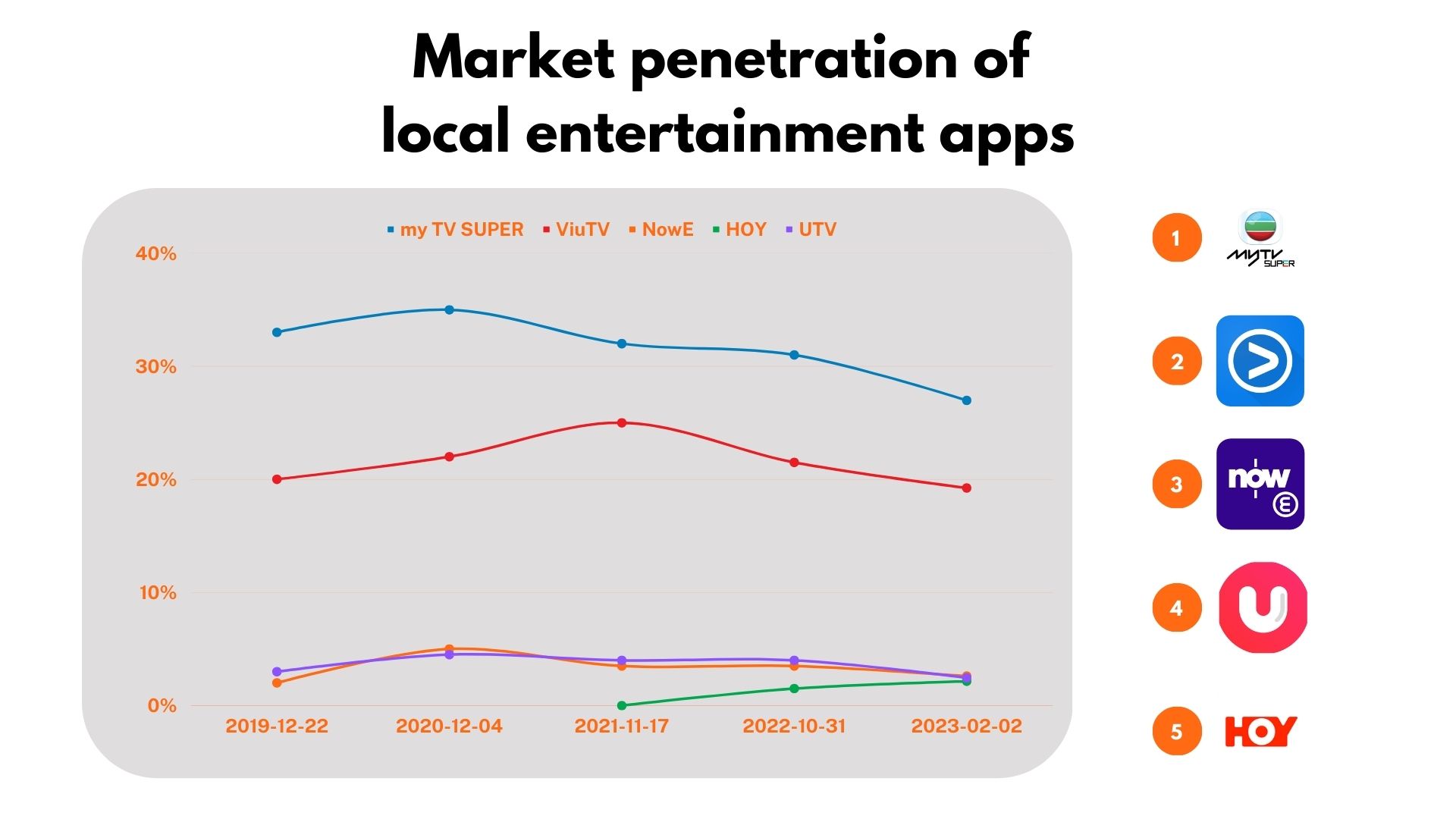

Market penetration of myTV SUPER dropped from the peak in 2019 of 36% to 27%, but remains No. 1 among local entertainment apps, followed by Viu TV at 19%. Overseas entertainment TV streaming Apps Netflix and Disney+ experienced a proliferation in installation rate, from 15% to 33% and 0% to 7.5% respectively. As the #2 OTT platform, Viu has achieved a relatively steady market penetration at 15%.

▲ Figure 9 – market penetration of local entertainment apps

▲ Figure 10 – market penetration of overseas & China entertainment apps

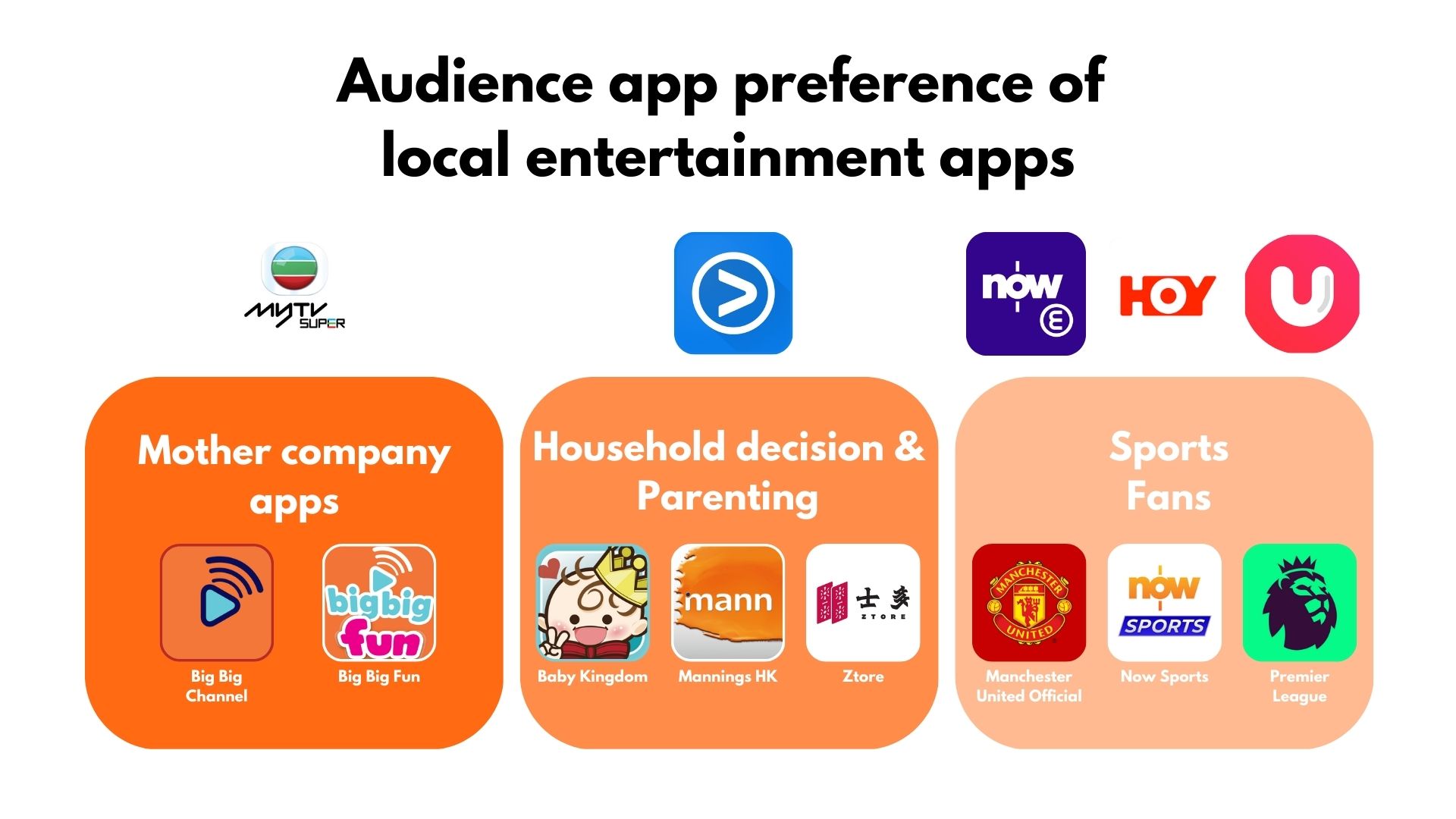

Installers of myTV SUPER are likely to be loyal users of TVB (自家平台), with mother company apps installed simultaneously such as big big channel and Big Big Fun. With Baby Kingdom, Mannings HK and Ztore installed, audiences of myTV SUPER and ViuTV show concrete clues of the audience being home-decision makers and are parents with kids.

As for audiences of Now E and HOY, they are expected to be sports fans, as Manchester United Official App, Now Sports and Premier League are installed.

▲ Figure 11 – audience app preference of local entertainment apps

Similar to local entertainment apps, overseas TV streaming apps’ audience are probably parents with kids and home-decision makers as shown with Baby Kingdom, ToyRUs and WSD Mobile installed. However, they tend to be outdoorsy people, due to apps like ChargeSPOT, HK Ticketing, Hong Kong Disneyland being installed. Also they are traditional shoppers who will visit malls & physical stores like K11 HK, Sino Malls, IKEA and Fortress.

A noteworthy difference between local & overseas entertainment apps and China apps is the latter, namely iQIYI and bilibili describe the audience as the younger generation and being hard-core gamers with apps installed – Twitch, Discord, 17Live and so forth.

▲ Figure 12 – audience app preference of overseas and China entertainment apps

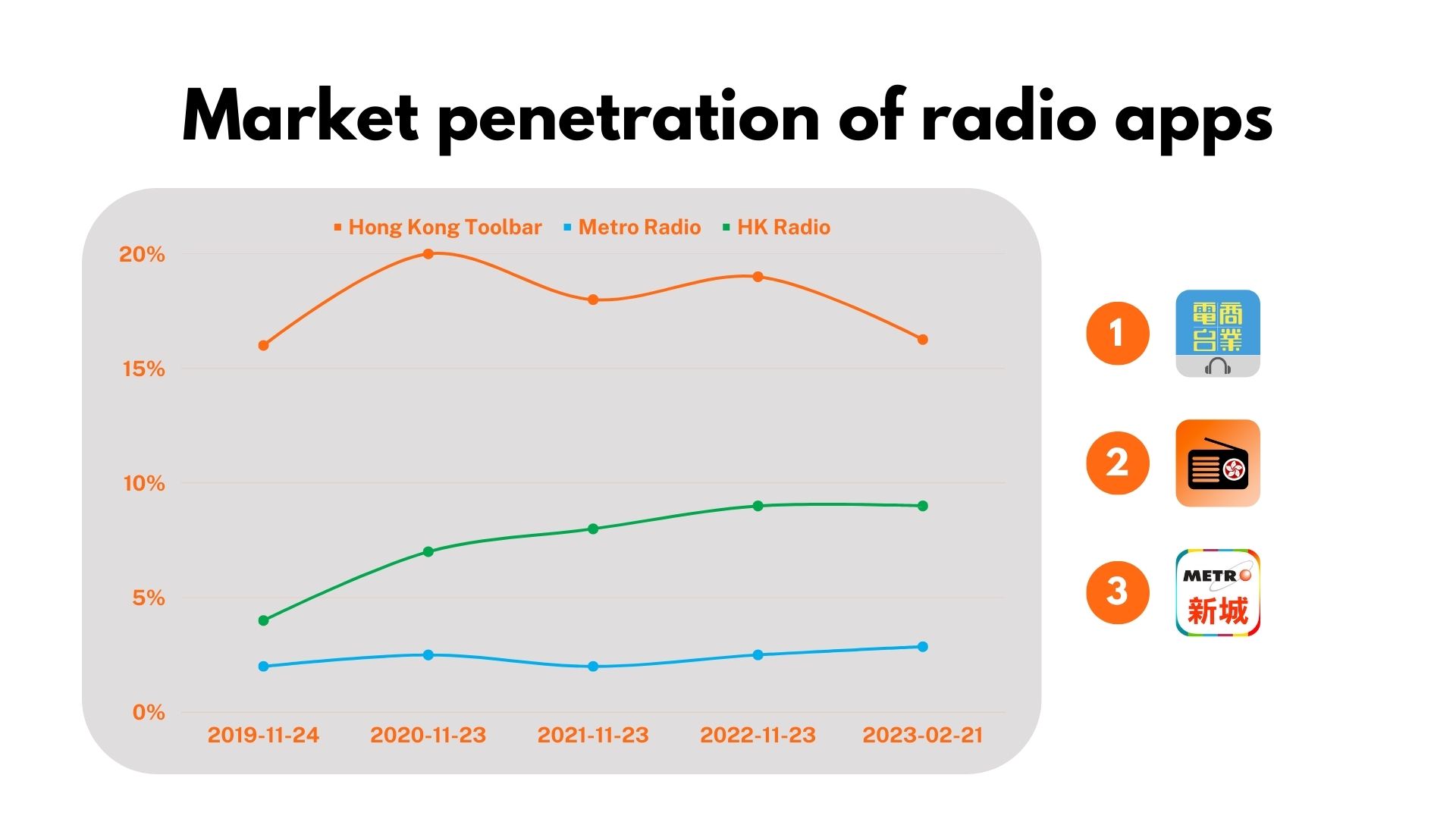

Radio apps show a high correlation with Hong Kong Jockey Club

The market penetration of HK radio apps can be depicted with AppVois, Hong Kong Toolbar hit a penetration of 16% while the second place goes to HK Radio of 9%.

▲ Figure 13 – market penetration of radio apps

With Hong Kong Jockey Club Apps, e.g 馬會電視頻道, 馬會投注三合一, 香港六合彩 installed, audiences of four radio apps appeared to be horse racing or football lovers and probably are HKJC members who bet and enter premises.

The profile of HK Radio shows app preferences in Step Tracking, Blood Pressure App, Enjoy Hiking and Yahoo Weather show audiences are health-conscious and likely to be nature-love who often have outdoor activities.

▲ Figure 14 – audience app preference of radio apps

Data Collection & Disclaimer

Vpon integrates with premium mobile apps/sites. When the user browses the mobile apps/websites, corresponding ads request is sent to the server and basic mobile device information of the user would be collected.

With its extensive database, AppVois provides comprehensive insight on every app’s user preferences, trends on different app categories, competitive product trends and general trends of the app market, allowing AppVois users to grasp the ever-changing app market.

The data provided in this publication are derived from Vpon’s database and pledges to comply with the requirements of the Laws of Hong Kong. We ensure compliance of our platform with the strictest standards of security and confidentiality.

The information and material contained in this site are for general references only. If you intend to rely on or avoid taking any action based on the contents of this publication, you are strongly suggested to obtain professional advice. Vpon makes no express or implied representation, warranty, or guaranty as to the accuracy, appropriateness or completeness of any information contained in this publication.

Please refer here for AppVois: AppVois presents data based app market analysis! | Vpon Big Data Group

▌Please contact us if you have any further enquiries.